For any business, invoicing is more than just a routine administrative task; it’s the backbone of your revenue stream. Yet, many companies overlook inefficiencies in their invoicing process, assuming that as long as invoices are sent, payments will follow. Unfortunately, this mindset can be costly.

Hidden invoicing inefficiencies lead to delayed payments, cash flow disruptions, increased administrative costs, and even lost revenue due to errors or disputes. A slow, outdated, or error-prone invoicing system not only bothers your accounting team, but it also affects your entire business.

Late or incorrect invoices can strain client relationships, reduce trust, and create unnecessary back-and-forth communication. The good news is that you can find an easy escape from these issues. This blog explores the true cost of inefficient invoicing, highlights common mistakes businesses make, and outlines practical solutions to ensure your invoicing process works for your business, not against it.

Key Takeaways

- Lost Revenue: Inefficient invoicing can cause lost revenue, operational inefficiencies, and damaged client relationships, impacting overall business growth.

- Small Errors: Even small invoicing errors, such as missing details, typos, or delayed submissions, can lead to significant financial losses and cash flow disruptions.

- Streamlined Process: Automating invoicing, setting clear payment terms, sending invoices promptly, and implementing follow-up systems improve financial transparency.

- CollabCRM Integration: Link client data, sales pipelines, and payments to manage clients effectively and ensure accurate, timely billing.

What is the True Cost of Inefficient Invoicing?

The true cost of inefficient invoicing includes lost revenue from delayed or incorrect billing, damaged market reputation due to unprofessional or inconsistent invoicing practices, and poor client relationships stemming from billing errors or confusion.

Additionally, it creates operational inefficiencies through manual data entry and redundant processes, as well as legal and compliance issues that can result in penalties. Together, these hidden costs erode profitability, slow business growth, and threaten long-term stability. Here is a detailed breakdown of each cost you might have to pay:

1. Lost Revenue

Untracked invoices can slip through the cracks and lead to uncollected amounts, payments or profits.

Some invoices may go unnoticed or unpaid for months if your organization doesn’t have a follow-up system, resulting in direct financial losses and revenue decline.

2. Damaged Market Reputation

For businesses looking to scale, an inefficient invoicing system can be a major roadblock. Investors and financial institutions assess cash flow management before providing funding. If a business struggles with invoicing inefficiencies, it may struggle to secure credit or investment opportunities.

3. Poor Client Relationships

Repeated invoicing mistakes, such as incorrect amounts, missing details, or sending invoices to the wrong contact, can frustrate clients and damage trust. Poor invoicing practices can make a business appear disorganized and unprofessional, potentially leading to lost customers or contract terminations.

4. Operational Inefficiencies

An inefficient invoicing process consumes unnecessary time and resources. Manually correcting errors, chasing late payments, and handling invoice disputes take away valuable hours that could be spent on revenue-generating activities. The more time spent fixing invoices, the higher the labor costs, reducing overall business efficiency.

5. Legal and Compliance Issues

Inaccurate invoicing can result in tax miscalculations, incorrect financial reporting, and potential legal issues. Businesses that fail to properly document invoices may face penalties from tax authorities, the government or disputes from clients over incorrect billing.

How Do Small Invoicing Errors Lead to Big Financial Losses?

The top invoicing mistakes that delay payments and harm cash flow include incorrect or missing details, unprofessional formatting, and late invoice submissions, all of which create confusion and slow down revenue collection. Lack of clarity in payment terms, not following up on unpaid invoices, and relying on manual or outdated processes further exacerbate delays.

Together, these errors can lead to payment disputes, frustrated clients, and significant financial setbacks for your business. Here are the most common invoicing mistakes that hurt cash flow and how to fix them.

1. Incorrect or Missing Details

The longer you wait to send an invoice, the longer it takes to get paid. Many businesses fail to prioritize invoicing, leading to unnecessary payment delays. Late invoices also signal a lack of urgency to clients, reducing the likelihood of prompt payments.

2. Using Confusing or Unprofessional Formatting

If the invoice lacks a clear structure, clients may struggle to identify key details such as the amount due, due date, or payment instructions. Moreover, a poorly formatted invoice can make your business look disorganized and may not be taken seriously, potentially damaging your credibility.

3. Late Invoice Submission

One of the biggest reasons businesses face delayed payments is failing to send invoices on time. If you don’t send an invoice promptly, clients may not prioritize your payment, leading to cash flow disruptions. Moreover, many businesses have set payment cycles, and if your invoice arrives late, it may miss the next cycle, delaying your payment by weeks.

The longer you wait to send an invoice, the more likely the client is to forget about the work or service provided. It can lead to payment disputes or unnecessary back-and-forth clarification.

4. Lack of Clarity in Payment Terms

If your invoices do not have clear and well-defined payment terms, clients may delay payments due to confusion or uncertainty. Without precise instructions on due dates, late fees, and payment methods, businesses may process your invoice later than expected, negatively impacting your cash flow.

If an invoice simply states “Please pay soon” instead of specifying a due date, clients may not know when payment is expected. Some clients prioritize invoices with strict deadlines. If your terms are vague, they may assume payment is not urgent.

A client may argue that they were unaware of a late fee, discount, or deadline. Clear terms prevent these disputes. Clearly stating penalties for late payments and incentives for early payments motivates clients to settle invoices on time.

5. Not Following Up on Unpaid Invoices

Many businesses handle multiple invoices at once, and yours may have slipped through the cracks. A polite follow-up email or call can quickly resolve the issue. Some clients delay payments intentionally, especially if they know you won’t follow up. Regular reminders show that you’re actively tracking payments.

Large companies have complex approval processes, and they don’t take follow-ups to ensure your invoice moves up to the queue.

6. Using Manual or Outdated Processes

If you are still using manual invoicing methods like paper invoices, spreadsheets, or outdated software, you’re increasing the risk of errors, delays, and lost payments. Modern automated invoicing systems improve accuracy, efficiency, and cash flow.

Manually entering invoice details can lead to typos, incorrect pricing, or missing information. Errors often result in invoice disputes, delaying payments while corrections are made. If you don’t have an automated system, it’s easy to lose track of outstanding invoices or forget follow-ups. Businesses that rely on manual records often miss overdue payments.

How to Streamline Your Invoicing for Faster Payments?

Automate your invoicing system to reduce manual errors and save time. Double-check invoice accuracy and set clear payment terms to prevent confusion. Send invoices promptly and follow up consistently on overdue payments. Regularly audit your invoicing process, identify inefficiencies, refine workflows, and maintain consistent accuracy and a healthy cash flow.

Here’s how to make it happen:

1. Automate Your Invoicing System

Automating your invoicing system is the most effective way to minimize errors and save time. Instead of manually creating, sending, and tracking invoices, businesses can use invoicing software to handle these tasks automatically.

Automated systems generate invoices instantly, send payment reminders, and sync with accounting software, ensuring that invoices are issued promptly and recorded accurately. This eliminates the risk of lost invoices, reduces administrative work, and speeds up the payment process.

2. Double-Check Invoice Accuracy

Even small mistakes can lead to payment delays. Double-checking invoices before sending them ensures that all details, such as client information, services provided, due dates, and payment amounts, are correct.

Errors in calculations, incorrect tax rates, or missing details can cause disputes and slow down the approval process. By using invoicing software with built-in validation checks, businesses can reduce human errors and improve invoice accuracy.

3. Set Clear Payment Terms

Clearly outline due dates, late fees, accepted payment methods, and any discounts for early payments. When clients understand the expectations upfront, there is less room for confusion or disputes. Payment terms should be included in the invoice and communicated at the start of any business relationship to avoid misunderstandings later.

4. Send Invoices Promptly

Businesses should establish a routine for generating and sending invoices immediately after delivering a product or service. The sooner an invoice is sent, the sooner the client can process it, reducing the likelihood of late payments. Automated invoicing systems help ensure invoices are sent without delay and provide real-time tracking of their status.

5. Implement a Follow-Up System

Instead of expecting your clients to clear out all the bills on time, set up a reminder schedule. Use automated reminder emails at set intervals, personalize your approach, and offer flexible payment solutions. Implementing a structured follow-up process, including automated reminders and personal follow-ups, helps businesses stay on top of unpaid invoices.

Regular follow-ups ensure that clients are aware of their outstanding payments, reducing the risk of long-term overdue invoices and cash flow disruptions.

6. Regularly Audit Your Invoicing Process

Audit the invoicing process from time to time to identify inefficiencies and areas for improvement. Review your invoicing system periodically to ensure that invoices are being processed efficiently, payment terms remain effective, and automation tools are functioning correctly.

Also, analyze trends in late payments, client response times, and invoice errors to refine invoicing strategies, leading to a more streamlined and effective system.

Bottom Line

Your invoicing process should be a bridge to faster payments, not a roadblock. Every delay, error, or inefficiency chips away at your cash flow and growth potential. The solution isn’t working harder, it’s working smarter. By modernizing your invoicing system, setting clear expectations, and leveraging automation, you create a seamless payment experience that benefits both you and your clients. Money should move as efficiently as your business does.

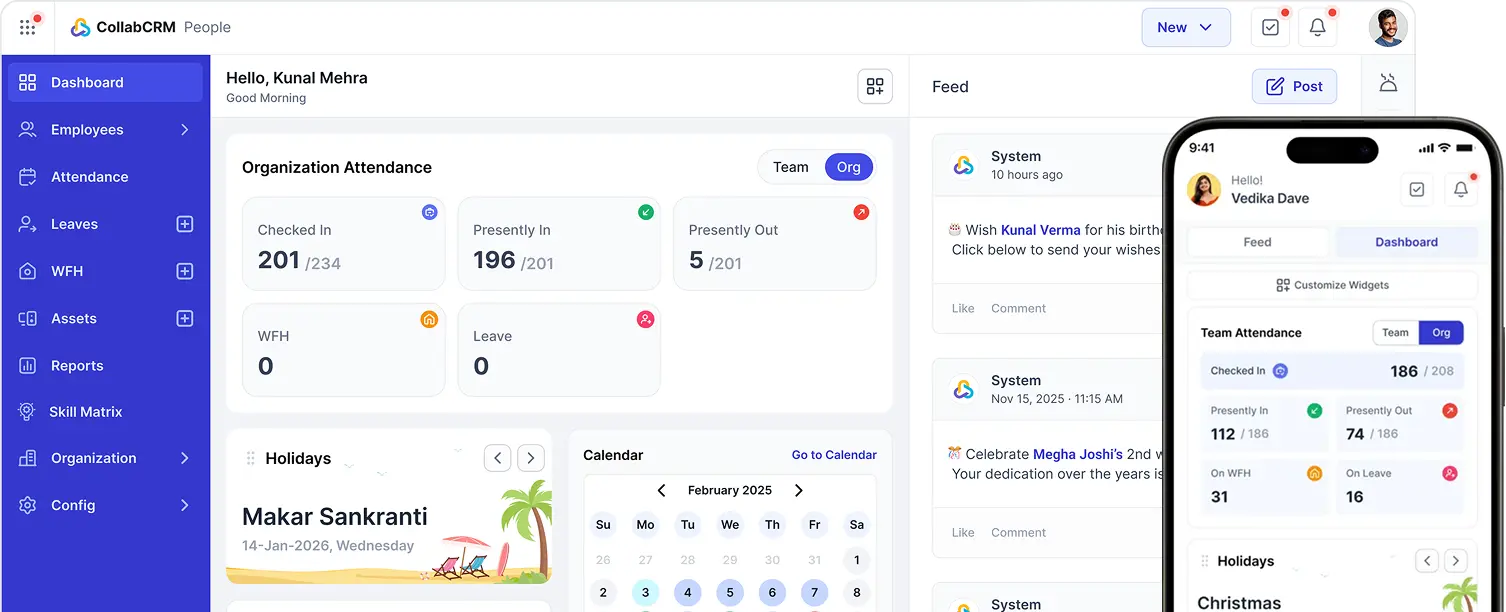

How Does CollabCRM Help You Manage Your Sales Process and Invoicing

CollabCRM is a business operating system that has a high-end CRM & Invoice Module to help IT companies manage client relationships while automating billing and invoicing. It connects customer management with financial operations, streamlining workflows and ensuring full transparency.

Teams can track goals, manage leads and deals, coordinate client interviews, and generate invoices efficiently.

The module provides performance visibility with summaries of achieved or pending goals, highlighting shortfalls or surpluses. It links client deals with project execution, reducing manual entry and improving coordination.

Integrated with the People Module, it notifies team leads for client interviews, ensuring the right resources are allocated. CollabCRM makes invoicing effortless with automatic invoice generation, payment tracking, and overdue invoice management, giving teams full control over revenue and financial transparency.

FAQs on Invoicing Mistakes

Compare the invoice with the purchase order and contract, identify errors, and communicate with the client or vendor. Correct the mistakes, confirm approval from both parties, and keep clear records to prevent future issues.

A misleading invoice presents inaccurate, incomplete, or confusing information, making the amount owed, payment terms, or delivered products/services unclear. It can trigger disputes, delay payments, and harm business relationships.

Double-check item descriptions, quantities, prices, taxes, and payment terms before sending. Use automated invoicing software and standardized templates to reduce errors and maintain consistent billing practices.

Errors include missing or incorrect details, mathematical mistakes, late submissions, unclear payment terms, duplicate invoices, and manual data entry mistakes. These issues delay payments and disrupt cash flow.

CollabCRM is a top choice for invoicing, offering automated billing, customizable invoice templates, and real-time payment tracking. It provides clear audit trails for transparency and integrates sales and project workflows, ensuring seamless invoicing and faster revenue collection.

No, creating a dummy invoice without a real transaction constitutes fraud. Using fake invoices for tax evasion or false accounting can lead to serious legal and financial consequences.