Imagine a project manager who just launched a high-priority campaign. Halfway through, the design costs doubled, and a key vendor raised their rates. Without a plan, the manager would be facing a financial crisis and a frustrated client.

Fortunately, the manager had a clear roadmap that flagged these budget leaks early, allowing for adjustment without panic. Many professionals find themselves in such situations, but few know how to manage a project budget effectively from day one.

A budget is more than just a list of costs; it is your project’s pulse. With a good budget plan on your side, organizations have been saving 28 times as much money as those that don’t.

In this guide, we will break down the essential strategies you need to master your project finances. Whether you are a seasoned pro or a first-time manager, you will benefit from this step-by-step roadmap designed to turn your budget into a dynamic tool for success.

Let’s dive in and ensure your next project stays in the green.

Key Takeaways

- A budget is your financial pulse, acting as a baseline to track progress and ensure profitability.

- Breakdown costs into specific line items (labor, materials, software) to uncover hidden expenses early.

- Always include a contingency fund to absorb unexpected risks without derailing the project.

- Regularly compare actual spend against your estimated budget to spot and fix budget leaks before they become crises.

- Use your budget to say “no” to scope creep. If the goals change, the funding must change too.

- Use historical data from current projects to make your future bids more accurate and competitive.

- Use project management software to automate tracking, eliminate human error, and maintain a single source of truth.

What is a Project Budget?

A project budget is a financial plan that outlines the estimated costs of all the activities required for successful project completion. It includes all the resources required, such as materials, equipment, and labor, and serves as a baseline to track spending and ensure the project remains profitable.

Imagine you’re tasked with building a new company website. Your budget isn’t just the price of the software; it includes the hours your designer spends on layouts, the cost of stock photos, and a buffer fund in case the client requests an extra page at the last minute.

Without this budget, you might spend all your money on the design and realize too late that you can’t afford the hosting to actually launch it.

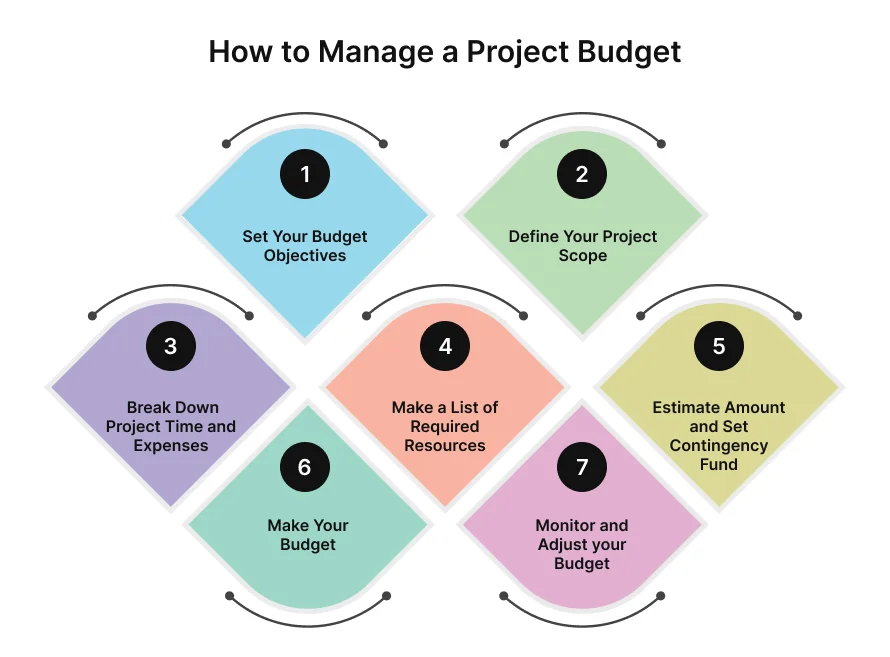

How to Manage a Project Budget in 7 Steps

To build your project budget, you need to follow these 7 steps, which will help you remove guesswork and help you lead your projects with success.

Step 1: Set Your Budget Objectives

Project objectives are the specific goals you plan to reach by the end of your work. Think of them as your guide that keeps you on the right track while you build the rest of your plan.

Setting these goals early is a vital part of project budget management. When you know exactly what you want to achieve, it is much easier to decide where to spend your money and where to save it. To make sure your objectives are solid, use the SMART method:

- Specific: Be clear about what you want to do.

- Measurable: How will you prove you succeeded?

- Achievable: Can you actually get it done?

- Realistic: Do you have the right tools and people?

- Time-bound: When is the deadline?

| For instance, instead of saying “I want to spend less on marketing,” a SMART objective would be: “I will reduce our social media ad spend by 10% over the next three months by focusing on organic content. |

Step 2: Define Your Project Scope

Once your goals are set, you must define your project scope. Defining your project scope is like drawing a line around your project. It helps to clearly define what work you will do and what should be avoided.

Setting these boundaries is a critical step for a healthy budget in project management.

When defining your scope, consider these three factors:

- Resources: Know your “hard” budget cap and team size before promising big results.

- Time: Tight deadlines often lead to higher costs, like paying “rush rates” to vendors.

- Non-goals: List what is not included to avoid expensive misunderstandings.

| Imagine you are hired to build a basic company website. Your scope clearly states you will build five pages and a contact form. Without a clear boundary, the client might ask you to just quickly add an e-commerce payment system or upload 500 product photos. While these seem like small additions to the client, they require hours of extra coding and testing. If these aren’t in your original scope, you end up doing complex technical work for free, which quickly drains your budget and eats your profit. |

Step 3: Break Down Project Time and Expenses

Instead of guessing the total cost of a project, break it down into small, manageable tasks. In your project tool, assign a cost to every piece of work, including labor, materials, and equipment. This detailed approach uncovers hidden costs that are easy to miss.

By looking at these smaller parts, you get a much clearer picture of your project management budget. It’s much easier to spot potential savings or stop an overrun when you can see exactly where every penny is going.

| For instance, if you are developing a custom CRM system for a client, don’t just estimate one price for the software. Break it down into specific line items like these: Database Architecture: Building the secure foundation for client data. Security & Compliance: Hiring a specialist to ensure the data is encrypted and meets GDPR or local laws. UI/UX Design: Creating a user interface that is actually easy for the sales team to use. API Integration: The cost of connecting the new CRM to the client’s existing email and accounting tools. Legacy Data Migration: The time and labor required to move thousands of old records into the new system without losing data. |

Step 4: Make a List of Required Resources

After you have broken your project into different tasks, the next activity is to find what you need to get the work done. In project budget management, a resource is anything that costs money or time. Being specific here prevents surprises later in the project.

Here are the most common categories to include:

- Team Members: Identify who is doing the work. Will you use in-house staff, or do you need to hire contractors?

- Professional Services: Do you need outside experts, such as legal consultants for compliance or a specialized marketing agency?

- Software and Equipment: List all necessary tools, from servers and laptops to software licenses and cloud storage.

- Training and Research: Factor in the time and money needed for your team to learn new systems or conduct user studies.

- Space and Travel: Take into account the needs like office rentals, travel expenses, or lodging if the team needs to be on-site.

Step 5: Estimate Amount and Set Contingency Fund

Since a budget is essentially an educated guess, using proven estimation techniques is the best way to improve your project budget management. You don’t have to estimate blindly. Instead, use these professional approaches:

- Bottom-Up Estimation: Total the cost of every small task identified. This is the most accurate way to budget a project.

- Top-Down Estimation: Start with a fixed total and work backward, carving out funds for each milestone.

- Historical Data: Looking at past projects can help you predict where costs usually stay on track and where they tend to spike.

- Scenario Planning: For complex projects, estimate the best case, worst case, and most likely costs, then average them.

Finally, always include a contingency fund. This acts as a safety net for unexpected risks, like a sudden software price hike or a developer falling ill. In our experience, setting aside at least 5-10% of your total budget as a buffer ensures that a small surprise doesn’t derail the entire project.

Step 6: Make Your Budget

By this point, you have already figured out your objectives, resource requirements, and estimated costs for each. Now you can start working on your actual budget document.

Here is what you should include in the document:

- Line Item Descriptions: Clear names for every technical task or resource (e.g., API Integration or Cloud Server Setup).

- Cost Categories: Group items into categories such as Labor (Developers, QA), Assets (Server hosting, API licenses), and Operations (Project management tools).

- Resource Type & Quantities: The specific talent or tools needed, such as Senior Backend Developer or AWS Instance, and the number of hours or licenses required.

- Unit Costs: The hourly rate for contractors or the monthly subscription fee for third-party software.

- Timeline (Cash Flow): When these costs will hit. For example, Phase 1 (Design) will have high UI/UX costs, while Phase 3 (Deployment) will see a spike in server costs.

- The Contingency Fund: A clearly marked 5–10% buffer to handle known unknowns, like a security bug that takes longer than expected to patch.

- Budget Baseline: The final, approved total. Once this is signed off, it becomes the yardstick you use to measure whether you are over or under budget.

Step 7: Monitor and Adjust your Budget

To maintain effective project budget management, you must keep it current. If you don’t track your actual spending against your estimates, you won’t know you’re in trouble until the money is already gone.

You don’t need to record every tiny receipt the moment it happens, but you should set a regular schedule to review your expenses. During these check-ins, compare your actuals to your baseline to see if you are straying from the plan.

The best update frequency depends on your project:

- High-Speed Projects: If you are in the middle of a heavy development sprint with multiple contractors and high API usage costs, check your budget weekly. This allows you to catch resource leaks before they compound.

- Long-Term Projects: For long-term projects like building a custom CRM or a large-scale platform, a bi-weekly or monthly check-in is usually enough to monitor server costs and subscription overhead.

Learning how to budget a project means being ready to pivot. If you see an overrun in one area, you can adjust your spending in another to stay on track.

Why Effective Project Budget Management Matters

Since your project budget management reflects the context of your project, it can serve as a guiding light to align and track your team’s progress.

Planned budget management in place, will help you in:

1. Controlling Project Scope

When you have clearly defined your project scope, it becomes much easier to navigate changes without losing control of your finances. A clear scope acts as a boundary that protects your resources.

For instance, if a client requests new features mid-project, having a solid project budget management plan allows you to see the impact immediately.

You can then decide if these modifications fit within the original budget or if you need to have a professional conversation with the stakeholder to reset expectations and adjust the price.

2. Tracking the Progress of the Project

When you tie specific budget line items directly to your project deliverables, your budget becomes a secondary progress report. This level of detail makes it easy to see exactly where you stand at any moment.

By watching where the money is spent, you get a clear, real-time view of which tasks are on schedule and which ones are falling behind.

| For instance, In software development, your budget can tell a story that code cannot. For instance, if you are building a new mobile app and your budget shows that only 10% of the allocated QA testing funds have been spent, you know the app isn’t ready for deployment, even if the developers say the coding is done. You don’t need to look at a single line of code to know that the project is still in the debugging phase. |

3. Controlling the Project

Keeping a close eye on your spending allows you to spot overspending before it becomes a crisis. Often, costs change for reasons you cannot control, such as a vendor raising their prices or a technical delay.

If you catch a budget leak early, you can adjust your plans and ensure you still have enough money to reach the finish line.

For instance, you are halfway through a project and realize a specific piece of software is costing double what you expected. Because you are tracking your budget, you see this immediately.

4. Planning Future Projects

Tracking your current budget is the best way to prepare for your next one. By watching how your money is actually spent, you can see exactly where your initial guesses didn’t match reality.

For example, you might realize that your team consistently needs 20% more time for “Testing and Quality Assurance” than you usually plan for. Instead of making the same mistake on the next job, you can use this historical data to create a more accurate project management budget.

Over time, this improves your forecasting skills, making your bids more competitive and your profit margins much more predictable.

Impact of Poor Budget Management

Poor budget planning can have severe consequences. Without a clear financial roadmap, projects often face cost overruns, delays, and scope changes. In fact, Gartner research revealed that companies lost about 17% of their potential revenue and profit growth because of bad budget planning. Also, such projects are 45% more likely to exceed their financial limits.

Here are the primary impacts of poor budget planning:

- Risk of Budget Bleed: Without a strict baseline, extra tasks often find their way in without extra funding. This can lead to a situation where unmonitored expenses drain resources until nothing is left for the final, critical stages.

- Damaged Stakeholder Trust: If you constantly ask for more money due to poor planning, clients lose confidence. This can result in canceled contracts or a negative impact on the reputation, which makes winning future bids difficult.

- Frequent Team Burnout: When funds run low, teams often work longer hours to make up the difference, leading to stress and high employee turnover.

- Lower Quality: Cutting corners to save a failing budget is like skipping rigorous QA testing in software development, which results in subpar products and potential legal liabilities.

- The Domino Effect: Budgeting failures do not happen suddenly. Mostly, they start with a single domino that knocks over the rest. When you don’t prioritize project budget management, a small mistake in the beginning creates a disaster at the end.

Best Practices for Managing a Project Budget Effectively

Effectively managing your finances ensures that your team remains focused, your stakeholders stay confident, and your project reaches the finish line without exhausting its resources.

By following these industry best practices, you can turn your project management budget from a static document into a dynamic tool for success.

1. Make a Realistic Budget Plan

Make a budget plan that is achievable. The aim should be to be realistic rather than being overambitious. Create a document to keep track of your insights. This will help you estimate costs accurately and align them with project goals.

2. Make a Contingency Reserve

Despite your best efforts, you cannot plan for certain unfortunate eventualities. In our opinion, keep a contingency reserve of about 5% to 10%. Create a backup plan so you know exactly how to respond when something unexpected occurs.

Planning for uncertainties helps you stay prepared if things don’t go as expected, and you may not even need to use your project contingency budget.

3. Monitor and Amend your Budget

Regularly compare actual expenses against the budget to identify variances early. In addition, update budget forecasts regularly to reflect changes in project scope or unexpected costs, ensuring alignment with the project’s progress.

4. Utilize Technology to Manage your Budget

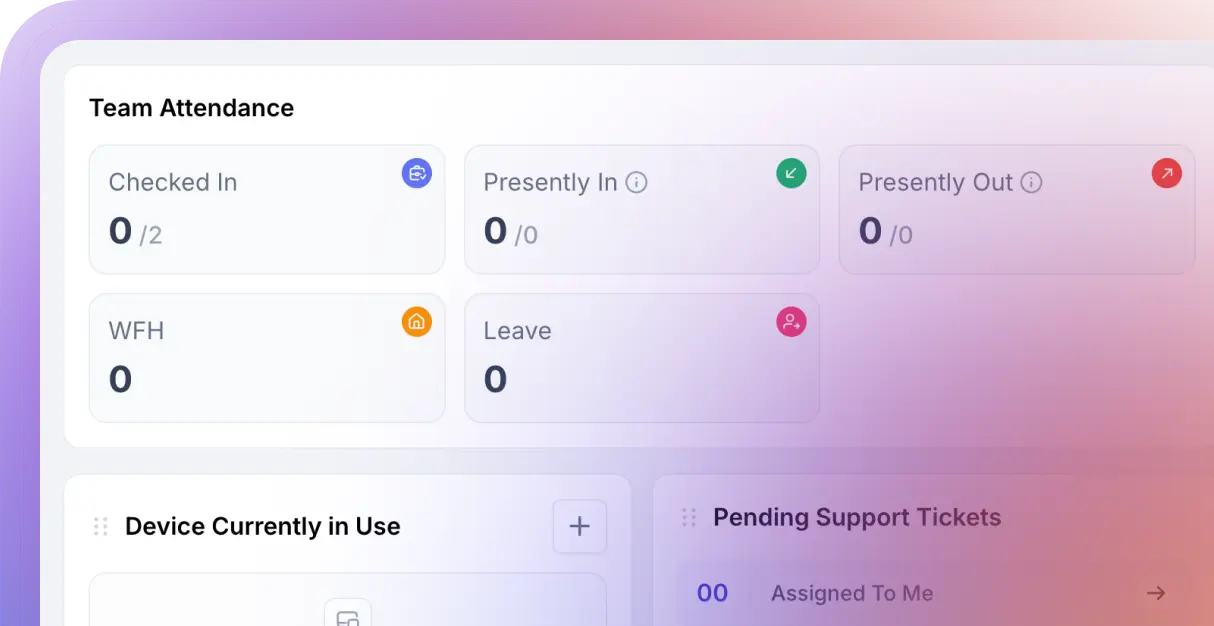

The key to making and managing your budget efficiently lies in leveraging technology. You should use project management software to automate your reporting and track spending in real-time.

This not only eliminates human error but also ensures that your financial data is always accurate and immediately accessible for decision-making.

5. Avoid Scope Creep

Scope creep occurs when a project loses its original focus and begins absorbing additional goals and tasks that weren’t part of the initial plan. In the budgeting process, these minor additions are dangerous because new ideas always require extra funds.

To protect your profit margins, it is vital to monitor for signs of scope creep early. By keeping a strict eye on your original project boundaries, you ensure that every dollar spent is actually moving you toward your primary objective.

Conclusion

Mastering a budget in project management is the difference between a project that merely finishes and one that truly succeeds. By following this 7-step roadmap from setting SMART objectives to leveraging real-time monitoring, you transform your budget from a restrictive spreadsheet into a strategic engine for growth.

Remember, effective budgeting isn’t just about preventing overspending. It’s about building trust with stakeholders, protecting your team from burnout, and ensuring high-quality results.

In the tech world, planning your finances ahead of time is your biggest advantage. For an IT company, this means moving past rough guesses and getting specific. For example, instead of just setting a vague budget for cloud migration, a smart plan accounts for the hidden costs, like fees for moving data, paying for extra software licenses during the transition, and hiring specialized security experts.

Having this level of detail acts as a safety net. When unexpected technical problems or technical debt pop up, you already have the financial oxygen needed to fix them. This allows you to solve issues quickly without having to cut corners or risk the quality of the entire project.

FAQs

To make a budget with a good structure, start by breaking your project into phases. Within each phase, list specific line items for labor, materials, and software. Organize these into a table with three main columns – Estimated Cost, Actual Spend, and Variance. This will help you to see exactly where you are over or under budget. Finally, always include a contingency line at the bottom to serve as a visible safety net for the entire project.

The seven steps for making a budget are: set your objectives, define your scope, break down time and expense, make a list of required resources, estimate the amount and contingency fund, make your budget, and monitor and adjust your budget.

The frequency depends on the project’s speed. For high-velocity projects with daily expenses, a bi-weekly check-in is best. For longer-term corporate projects, a monthly review is usually sufficient. The goal is to find a budget leak while you still have enough time and funds to fix it; waiting until the end of the quarter is often too late.